Impact Investing

Another Way to Stand Alongside Changemakers Who Lead for Justice in Their Communities

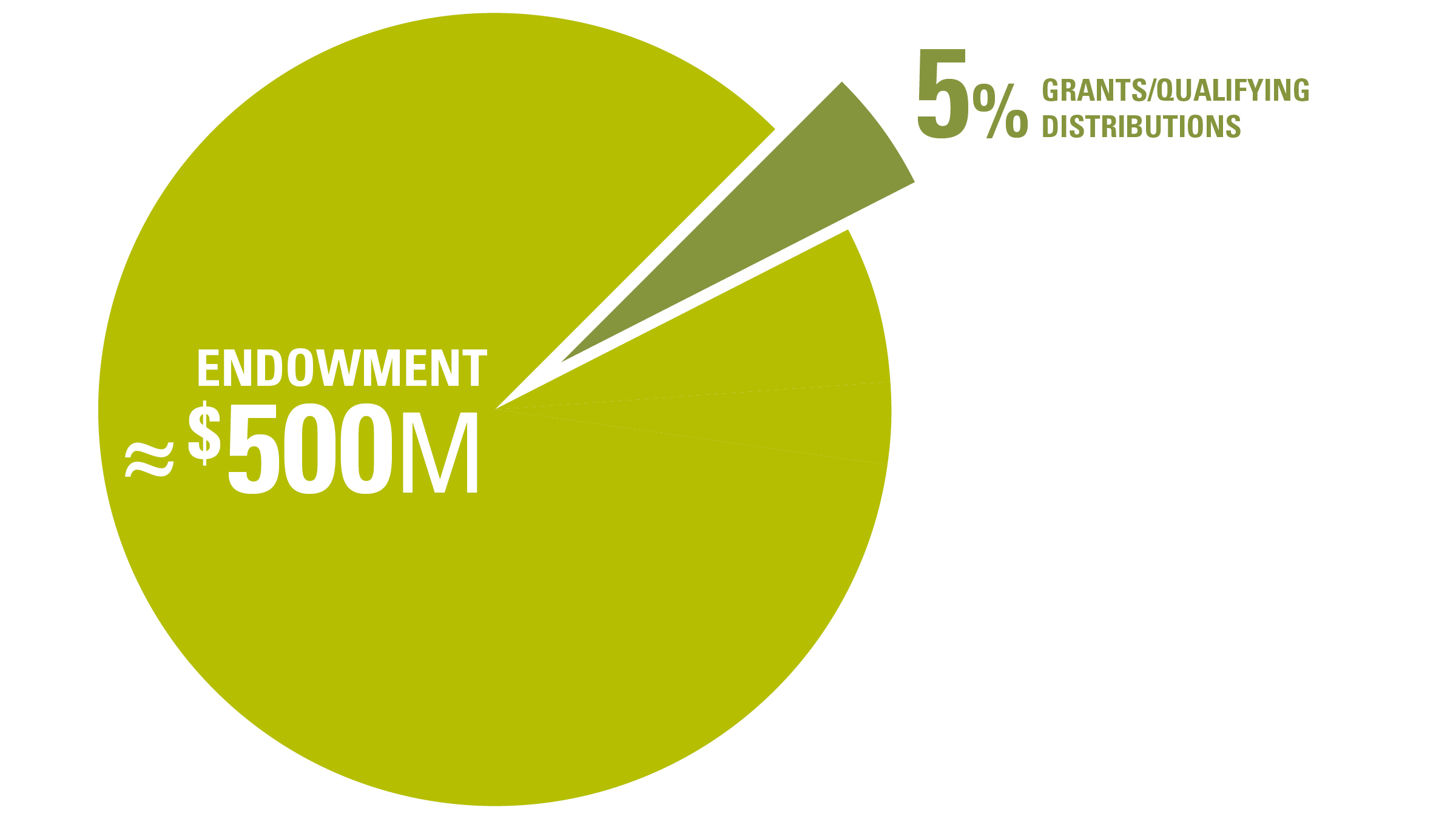

Since 2004, we’ve been striving to use every dollar we control to support the change the communities we support want to see in the world. We have an endowment of about $500 million invested in a variety of assets. We use the returns on those investments to make grants to nonprofits. We also make impact investments that create positive social impact that advances our mission, along with financial returns. The grants and impact investments support the mission and the communities we serve.

Our Mission

We stand alongside changemakers in our region of eight states and 76 Native nations and fund work that leads to racial, social, and economic justice.

Priority Communities

We support organizations that lead with courage, wisdom, and vision. They are advancing long-overdue change in deep connection with the land they inhabit and communities they serve—Native Americans, communities of color, immigrants, refugees, and people in rural areas.

Two Kinds of Impact Investments

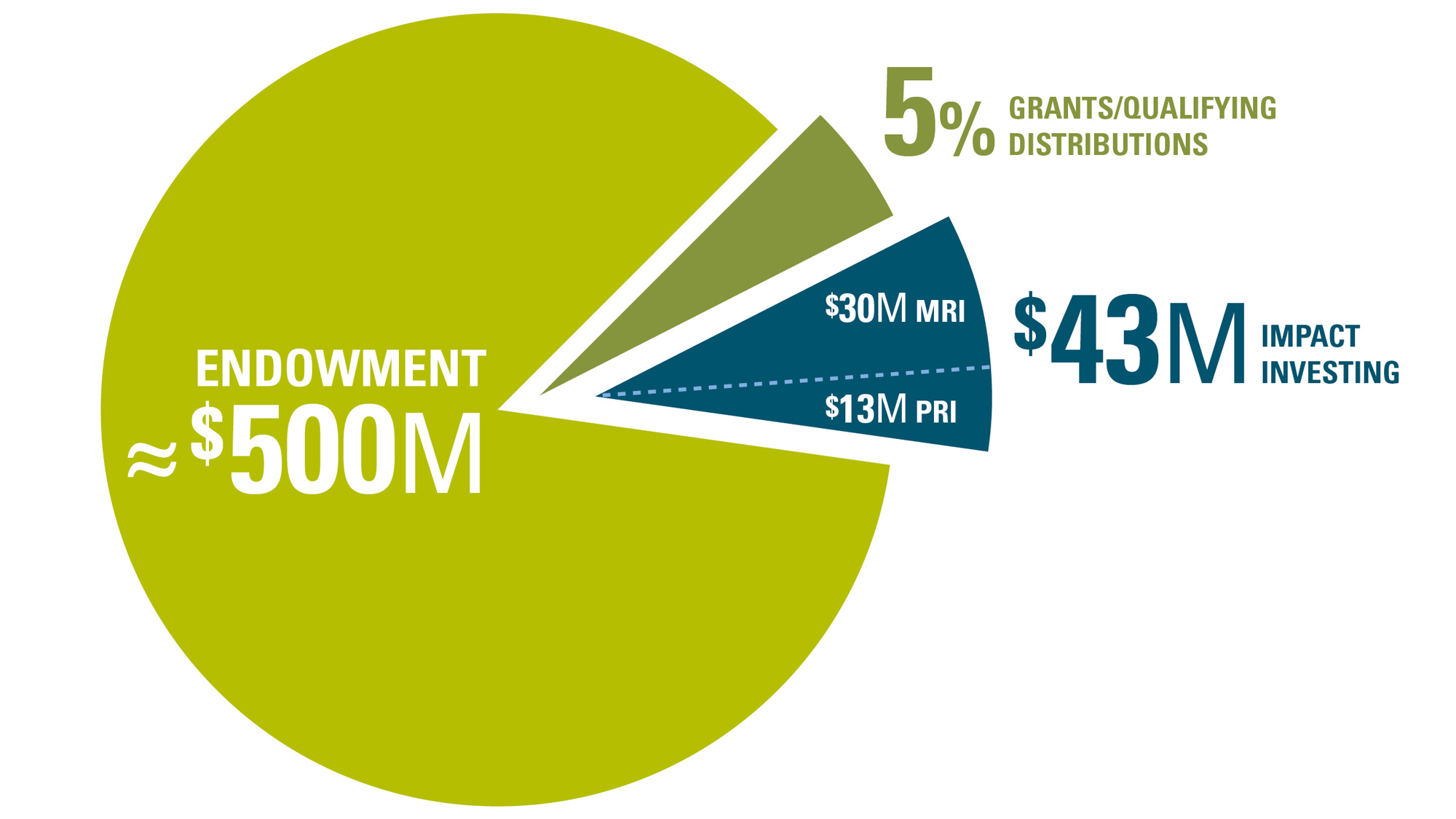

We pursue impact investments through mission-related investments (MRIs) and program-related investments (PRIs).

MISSION-RELATED INVESTMENTS

MRIs generate market-rate returns while supporting the aims of our grantmaking.

All our new MRIs are placed with investment managers from, or making investments in, our priority communities, as a way to increase the flow of resources into those communities.

CURRENT: More than $30 million is allocated in MRIs

BY 2030: We’ll increase our deployed MRIs to $50 million or more

PROGRAM-RELATED INVESTMENTS

PRIs prioritize social impact without expecting market-rate financial returns. We make low-interest loans to organizations led by our priority communities that respond to community needs and help their local economies be more just and vibrant.

PRIs come directly from our endowment, in addition to our grantmaking.

CURRENT: $13 million is allocated in PRIs

BY 2030: We’ll increase our deployed PRIs to $25 million

Introducing Our 2030 Impact Investing Strategy

20 years of impact investing, the last 10 years at roughly 10 percent of our endowment.

Total impact investing since 2004: Over $88 million deployed

Currently deployment: Roughly $43 million

2030 Strategy: We’re increasing our impact investing and further centering the communities we serve by managing our entire endowment with our priority communities in mind, making substantial increases in the deployment of impact investments, and placing all new impact investments with nonprofits and investees led by our priority communities, and more.

Using Our Entire Endowment in Service of Mission and the Communities We Serve

Our impact investment strategy strengthens support for our priority communities by managing our entire endowment with our priority communities in mind.

This includes:

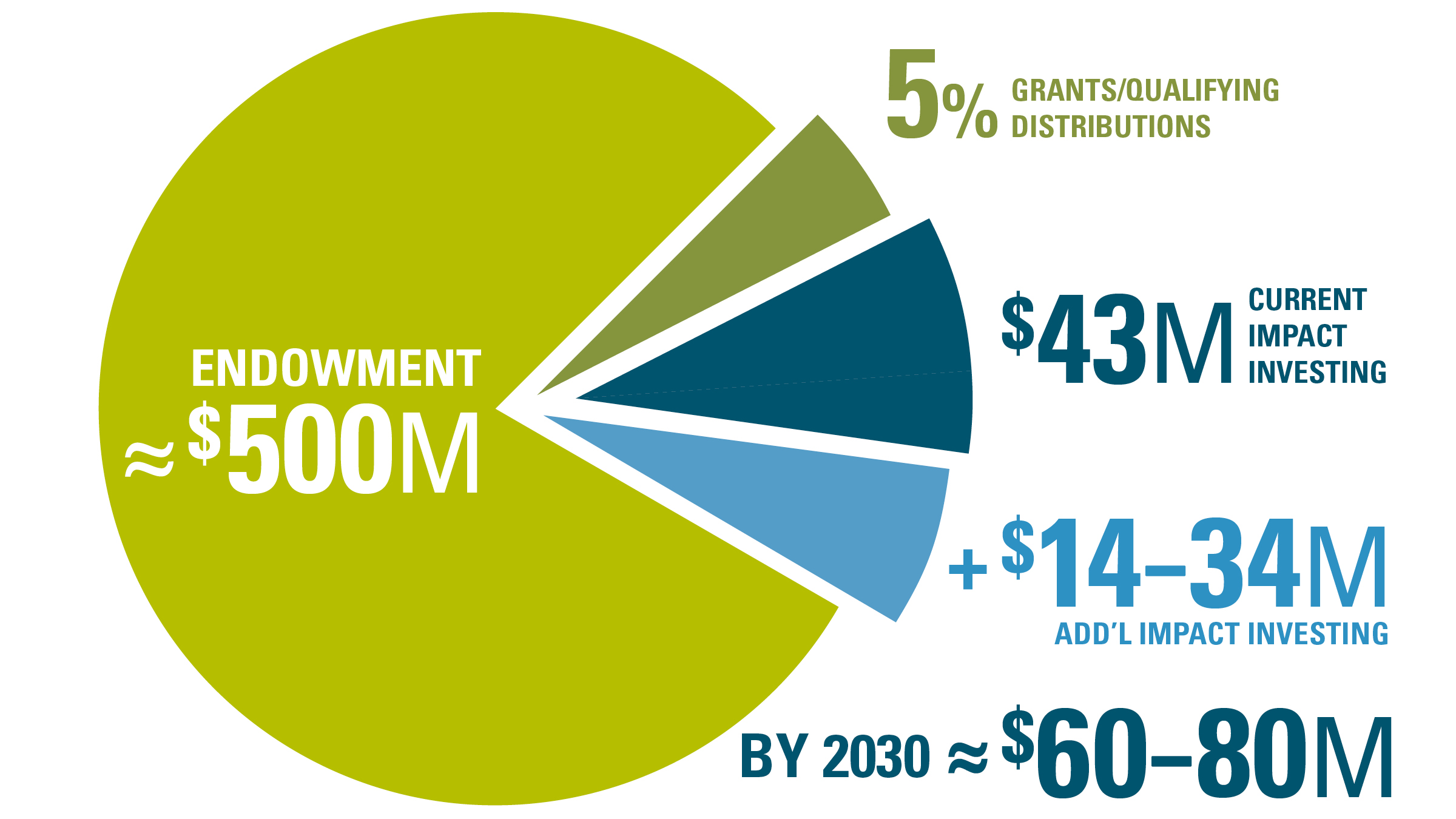

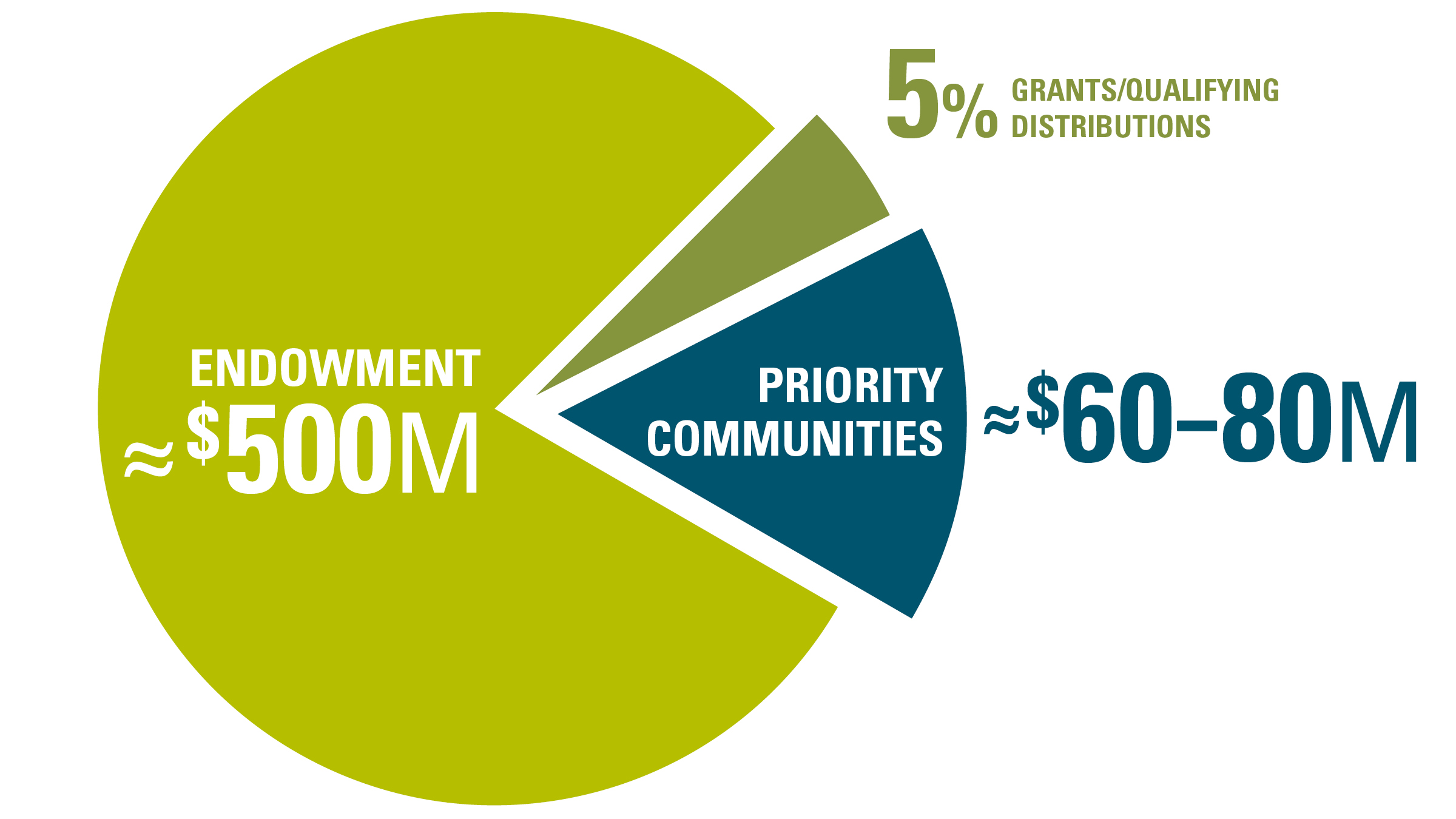

Increasing our current impact investments from $43 million to approximately $60–80 million by 2030.

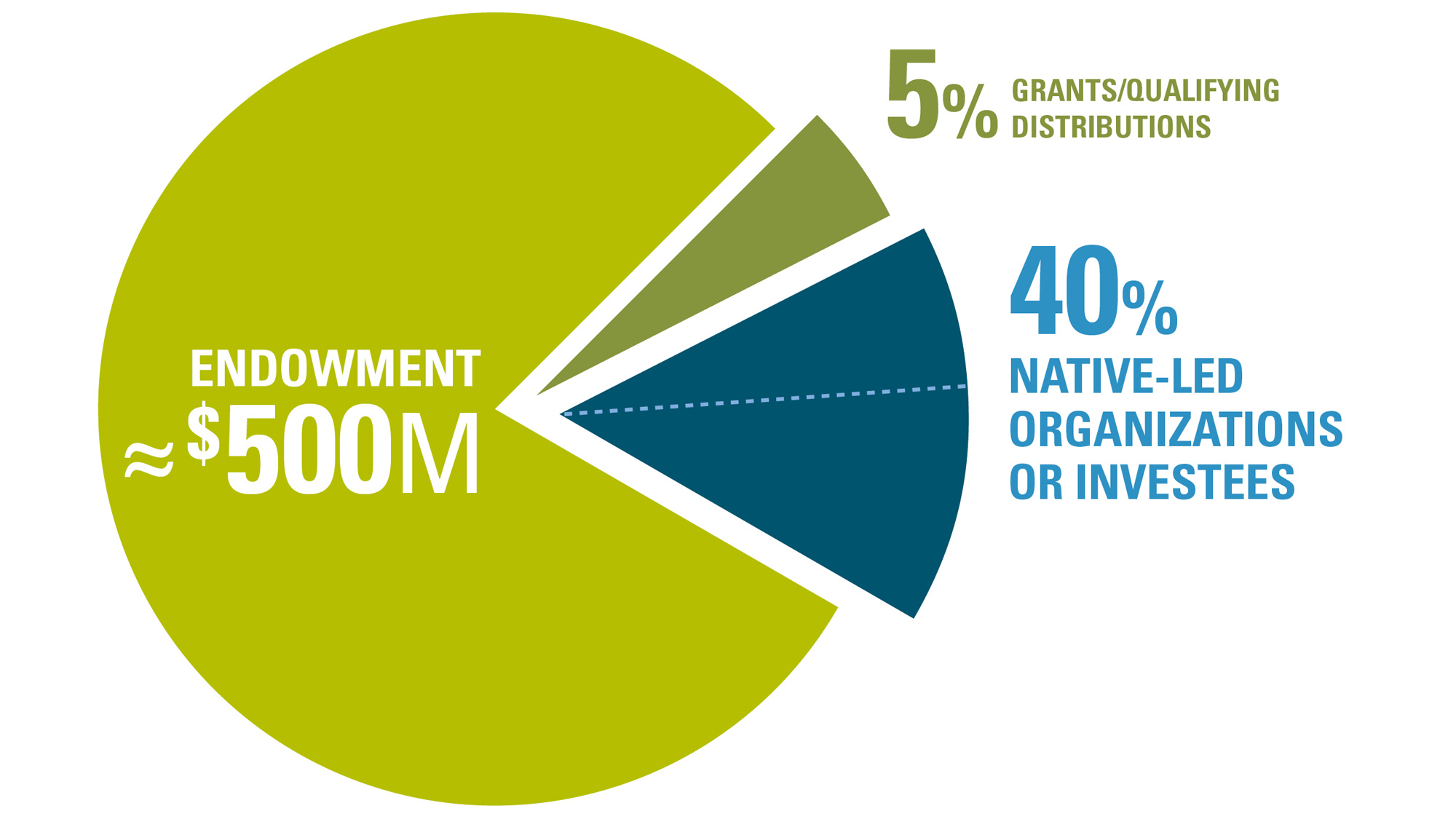

Committing at least 40 percent of all new PRIs and MRIs to Native-led nonprofits and investees.

Committing all new PRIs and MRIs to nonprofits and investees led by our priority communities.

Placing 30–50 percent of endowment assets under management with firms that rate highly for diversity, equity, and inclusion (DEI).

Becoming more environmental, social, and governance (ESG) aware.

An Explainer on What Our 2030 Impact Investing Strategy Looks Like

Here’s how our 2030 impact investing strategy looks in more depth.

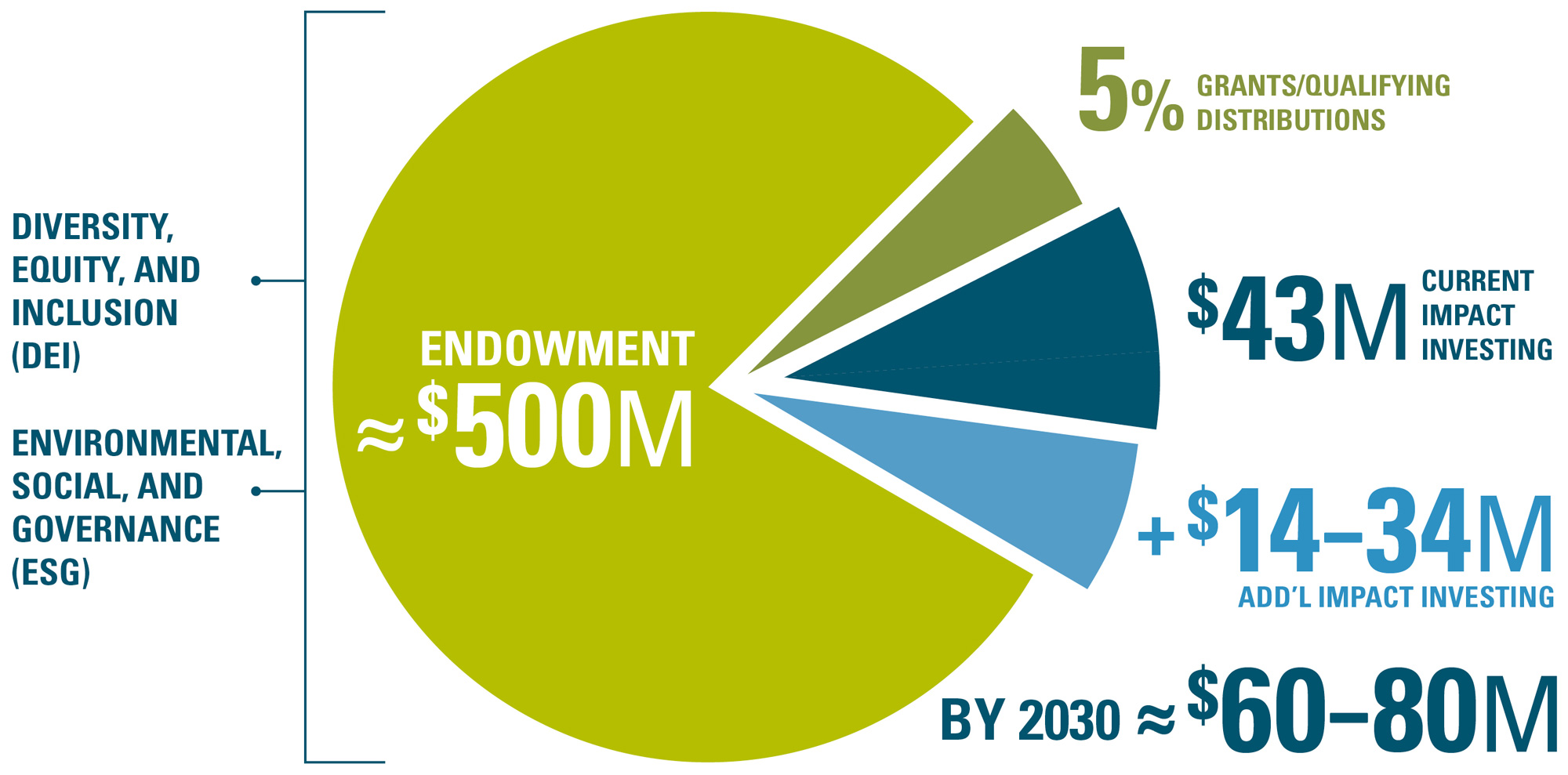

Five percent of this endowment we provide in the form of grants to nonprofits and use as other qualifying distributions, such as fees and salaries.

Currently, we deploy approximately another 10 percent of our endowment assets as impact investments, some of which are program-related investments (PRIs), prioritizing social impact without expecting market-rate financial returns, and the rest of which are mission-related investments (MRIs), generating market-rate returns while supporting the aims of our grantmaking. Current PRI deployment is at about $13 million and MRI deployment is at more than $30 million.

By 2030, we’re deploying an additional $14–34 million in impact investments targeting a total of $25 million deployed as PRIs and $50 million or more as MRIs.

DEI and our investment portfolio.

We’re also focusing on increasing the diversity, equity, and inclusion of the investment firms that manage our endowment assets. By 2030, we plan for 30–50 percent of our assets to be managed by firms that rate highly for DEI. This means that these firms will be in the top two categories of a five-point DEI rating scale (provided by our investment consultant) that our board approved in 2023. The rating scale takes into account both the staff at the firms and the leadership of portfolio companies.

Native Americans and our priority communities.

New impact investments go to nonprofits and investees led by Native Americans and people from our priority communities.

On top of this, we’ll make ALL of our new impact investments with nonprofits and investees from our priority communities. Our priority communities are Native Americans, communities of color, immigrants, refugees, and people in rural areas.

Environmental, social, and governance (ESG).

Finally, we’re taking steps to become more “ESG-aware” across our entire investment portfolio—understanding the ways our endowment investments impact the people and the planet, particularly among our priority communities.

ENVIRONMENTAL

Pollution

Carbon emissions and climate change

Resource utilization

Sustainability

SOCIAL

Employees

Customers

Suppliers

Community

Human rights

GOVERNANCE

Executive compensation

Management strategy

Board accountability

Shareholder treatment

Summary of the 2030 impact investing strategy.

Here’s a graphic representation of the strategy as a whole. We’re excited to move more money to mission and in service of our priority communities.

Talk to Us About Impact Investing and Our Commitment to DEI, ESG, and Native-Led

Ramya Rauf, VP of Finance and Administration/CFO »

Ramya leads the Foundation’s financial and administrative operations and supports the board’s investment and audit committees. She’s especially interested in impact investing that’s in line with the organization’s mission. She plays a key role in integrating justice, equity, diversity, and inclusion (JEDI) across the Foundation. She has over 30 years of experience in corporate and nonprofit sectors leading finance, accounting, IT, risk management, and treasury management teams.

Pakou Hang, VP, Program »

Pakou leads a team that works on the Foundation’s grantmaking activities and program-related investment portfolio. She and her team focus on building relationships and supporting the organization’s priority communities—Native Americans, communities of color, immigrants, refugees, and people in rural areas—through investments. Under Pakou’s leadership, the program team strives to support nonprofit organizations advancing social, racial, and economic justice. These organizations are committed to providing the opportunity, tools, and resources that allow communities to thrive on their own terms.