Mission Investing Measurement

Mission Investing

Lessons Learned

Since 2004, we have pursued mission investments to further grantees’ work to build assets, wealth, and opportunity. A comprehensive case study conducted by Pacific Community Ventures (PCV) measured the social impact of ten years of our mission investments, from 2006 through 2016.

Results

Social Returns

(as of 12/31/15)

Job growth compared

to 5% for

US private sector

Living wages for all

employees of

portfolio companies

Quality jobs with

health and

retirement benefits

Invested in

20 companies

Supported over

1,700 jobs

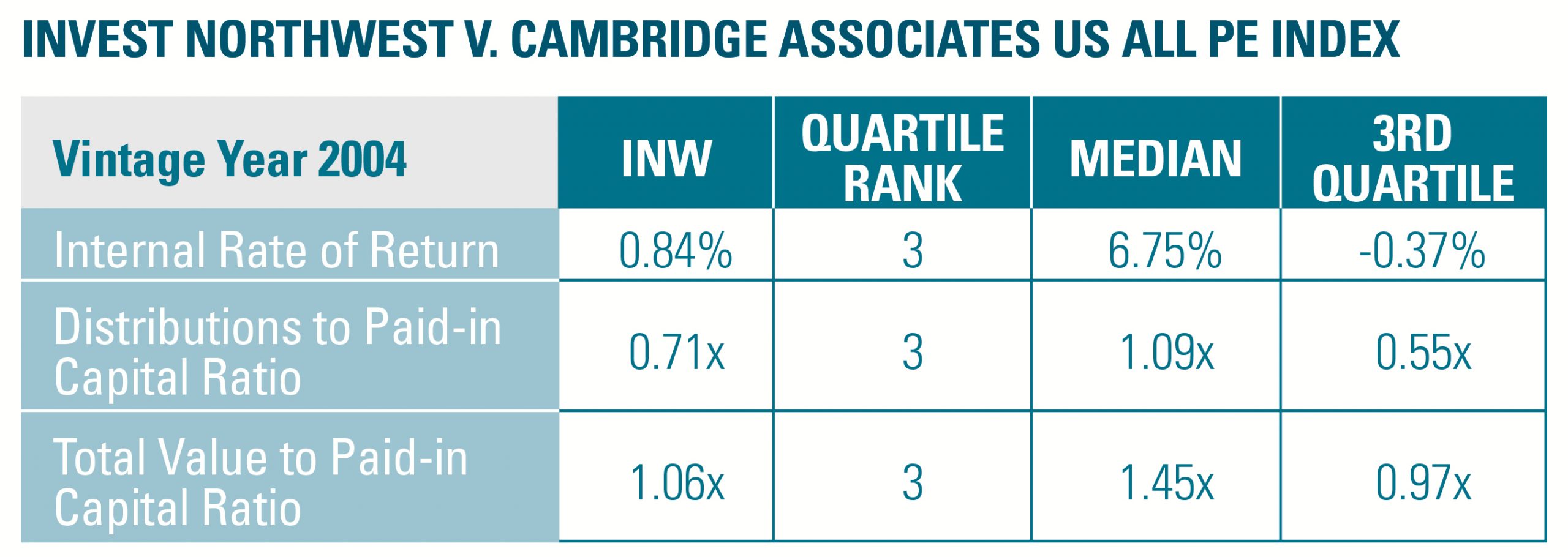

Financial Returns

(as of 12/31/16)

Insights

Custom funds increase the ability to target regions and outcomes, but limit the opportunity to partner with other investors and can be difficult to invest.

Impact objectives should be defined prior to investment and be understood and agreed on by all parties.

Market events, like those resulting from the 2008 recession, significantly impact returns; diversifying across multiple managers and investment strategies reduces risk.

Action

We’ve taken what we learned to heart. The results and insights have led us to increase our commitment to mission investing. We’ve dedicated another $10M to PRIs and $30M to MRIs. We’ve also changed our investment approach:

Use

Intermediaries

Instead of developing a custom fund, we’re investing through established managers and funds.

Expand Our

Geographic Focus

We’re expanding our focus to support businesses beyond our region, helping us meet our social impact targets and partner with other funders.

Define Social Impact

Before Investing

We’re establishing targets at the outset to better achieve and evaluate success.